How do Germans save, how do they prepare for retirement, which investment tools do they use and what role does media usage behaviour play in these decisions? The Gesellschaft für integrierte Kommunikationsforschung (Society for Integrated Communication Research, or GIK)* investigates this and other questions in its latest b4p trends survey.

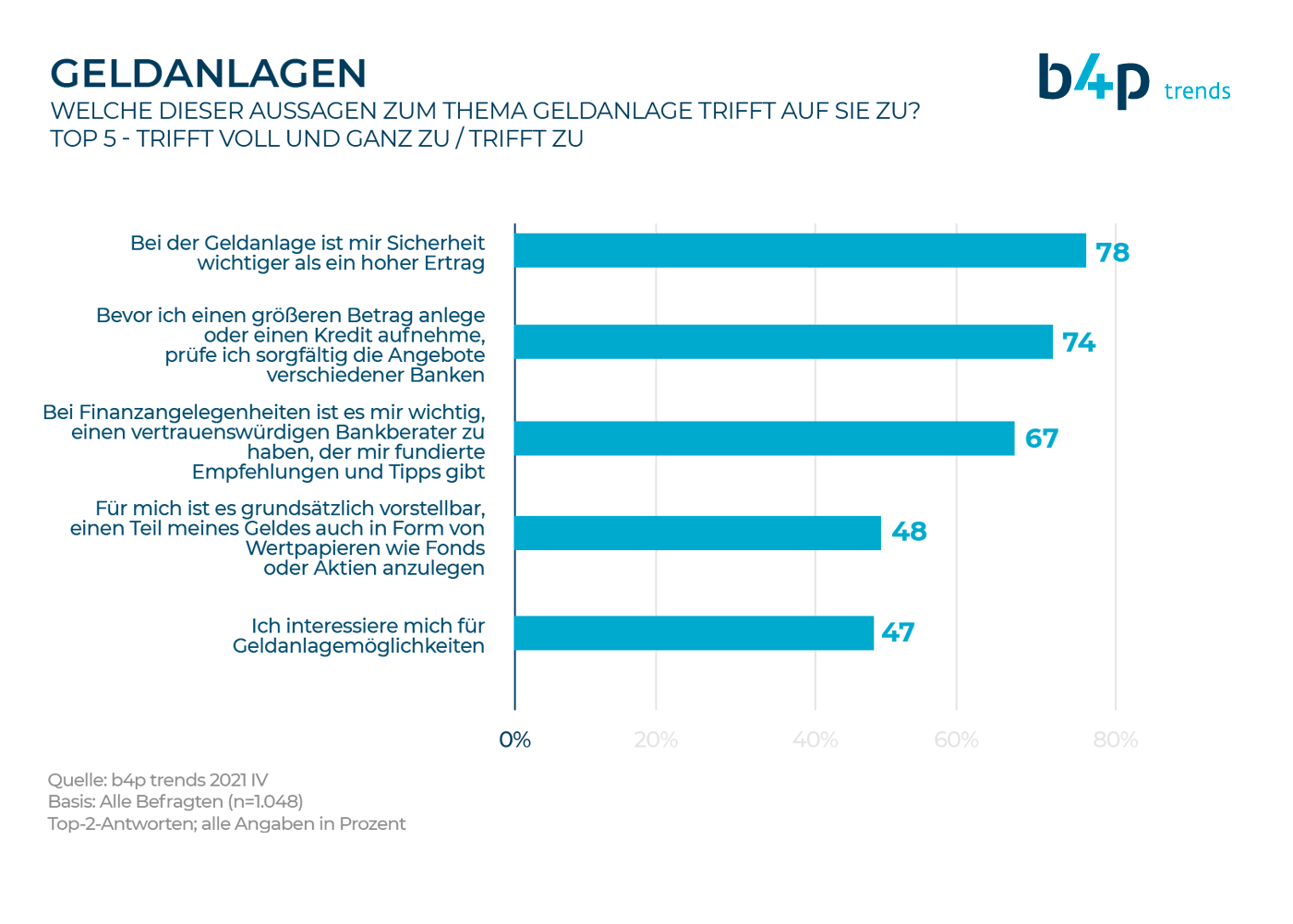

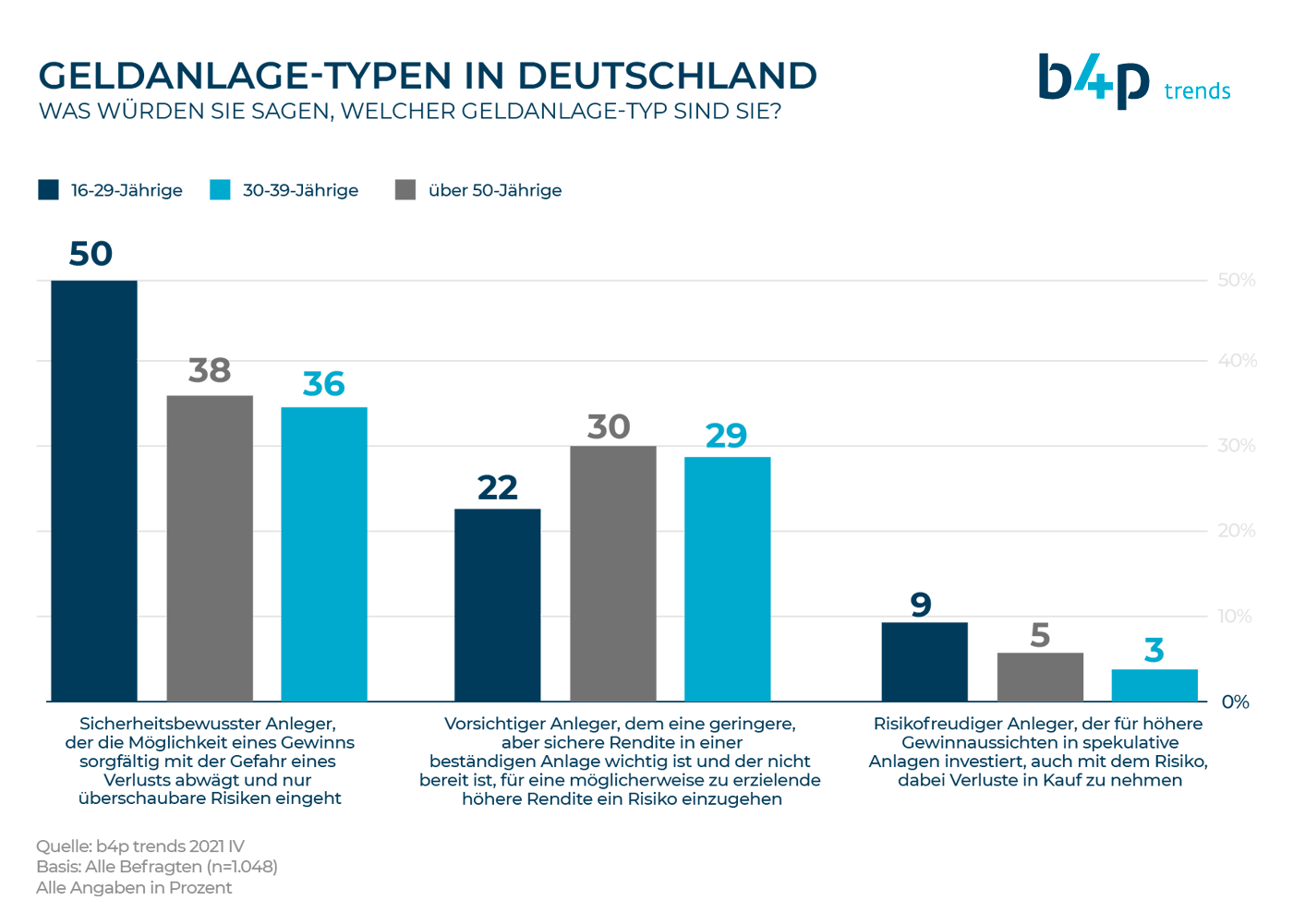

Germans tend to be conservative and more risk-averse when it comes to investments – an attitude that is also reflected in the results of the b4p trends survey. More than three quarters of respondents (78 per cent) attach greater importance to security than to high returns when it comes to their investments. This also is in line with the fact that as the need for security when it comes to investing money increases, the more Germans seek information. Accordingly, extensive media users can imagine investing part of their money in securities, significantly more often than respondents who almost never or never use media.

It seems that, above all, one’s own knowledge plays a major role in dealing with finances, because there is a clear connection between the willingness to invest and the extensive use of curated content in print and online media. Respondents who find their information via these media extensively are, for example, more likely than average to invest in private retirement schemes or to save. By contrast, Germans who extensively consume content in social media, from influencers and on video platforms invest less frequently than average.

Is my pension really safe or would it be better if I contributed to a private pension scheme?

Half of all respondents do not consider the state pension to be secure, especially younger respondents between the ages of 16 and 49 as well as career-oriented people. Only around a quarter (24 per cent) of Germans expressed a confidence in the state pension and consider it to be secure – primarily pensioners (40 per cent) and respondents with a monthly net household income of more than €3,000 (34 per cent). More than three quarters of respondents (78 per cent) consider the pension benefits from the state pension to be inadequate; in particular, women (80 per cent) and low-income earners (83 per cent) share this view.

However, although the majority of respondents consider the state pension to be insecure, only just under half (49 per cent) invest in private pensions – mainly people with above-average incomes and in the age group of 30- to 49-year-olds. In contrast, women aged 16 to 29 years invest the least in a pension scheme: Only a quarter of them have taken out a private pension so far.

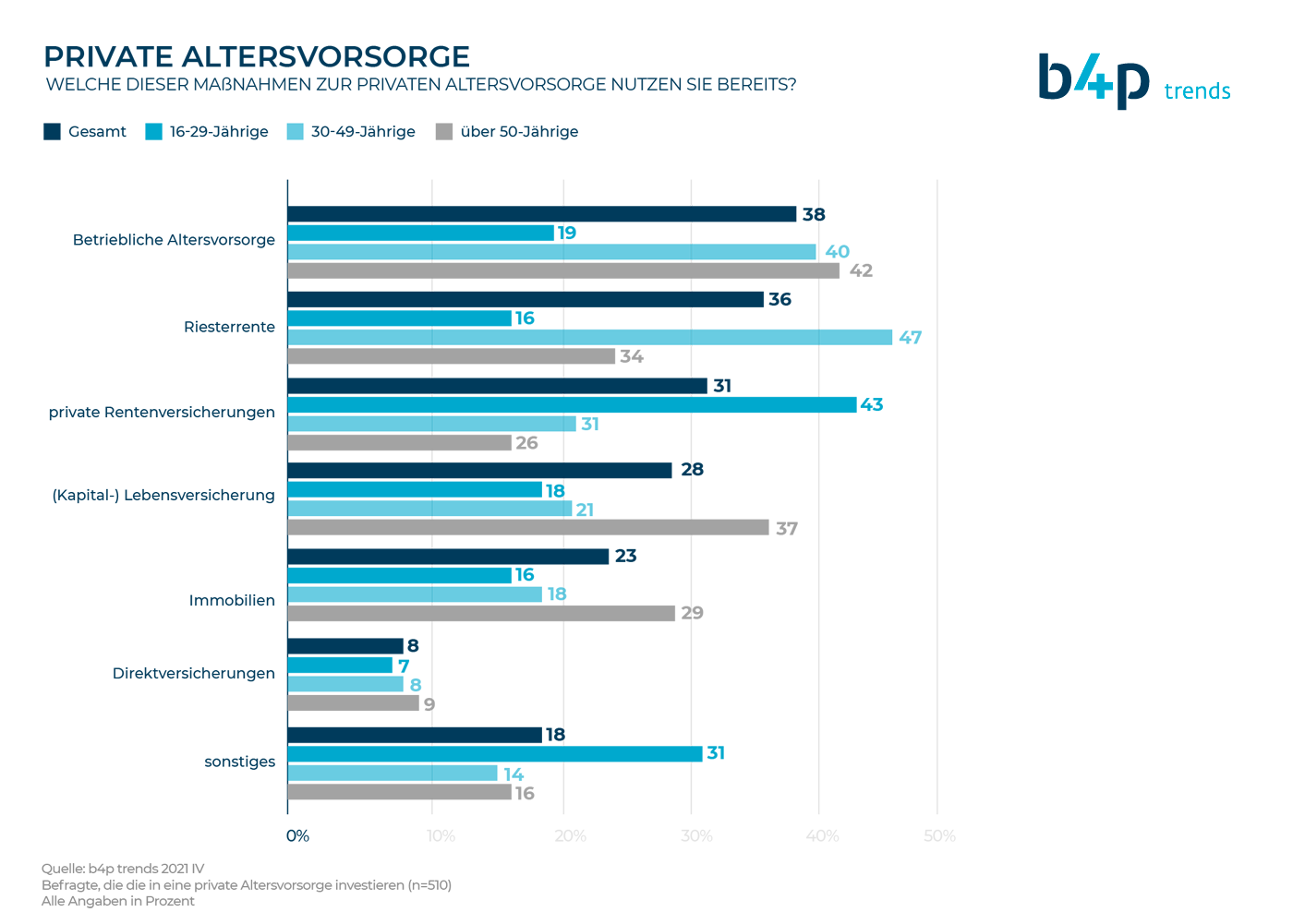

Just under half of those surveyed (49 per cent) have a private pension scheme, 28 per cent of whom also provide for their partner with a private pension and a further 14 per cent for their entire family. When it comes to investing in an additional private scheme, it is primarily a company-based pension scheme (38 per cent) and the German ‘Riester’ pension scheme (36 per cent), followed by private pension insurance policies (31 per cent), endowment life insurance policies (28 per cent) and real estate (23 per cent). However, those who have not yet taken out a private pension scheme for retirement do not plan to change this in the future – according to 52 per cent of those surveyed.

Save, save, save – and digitally, please

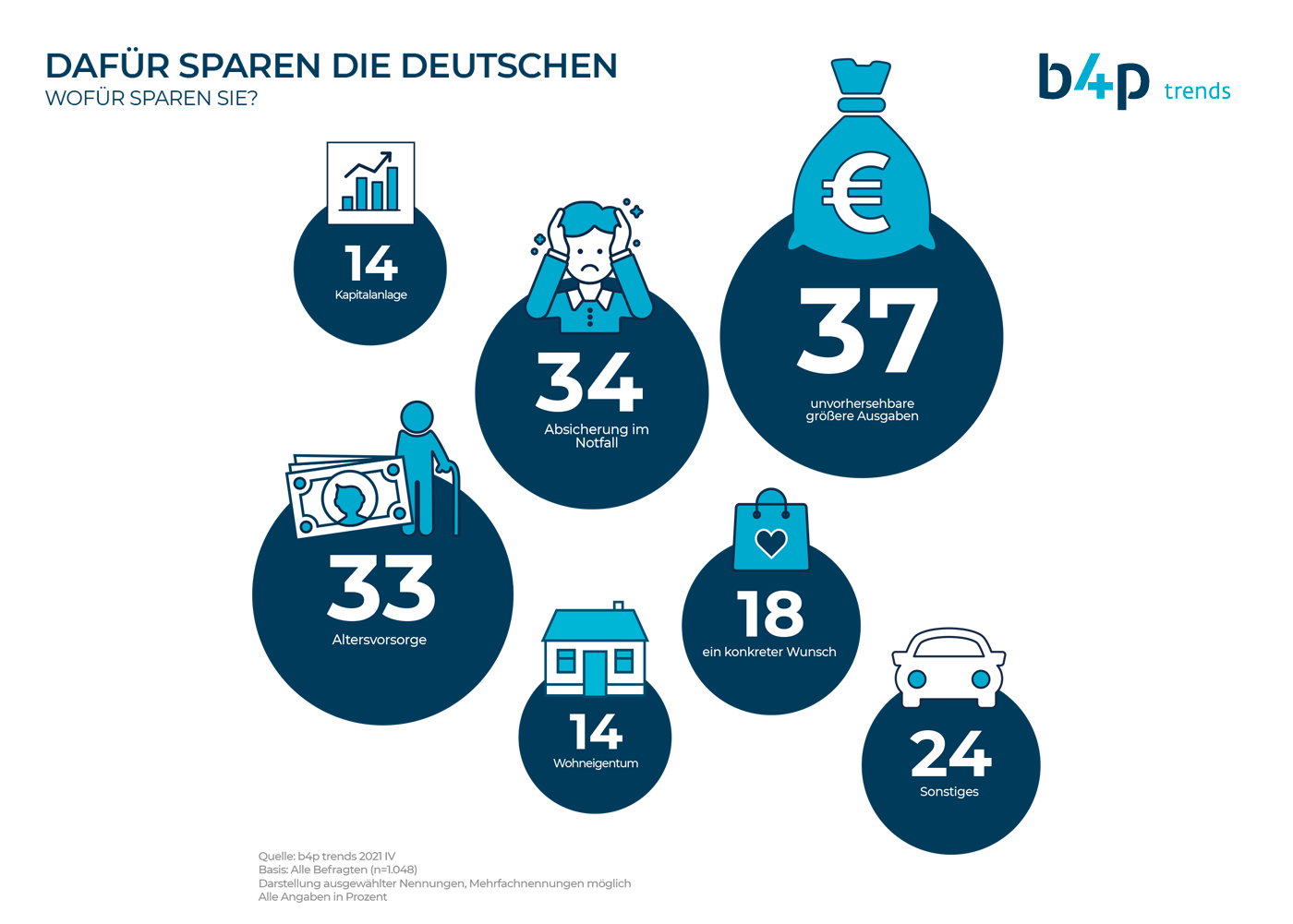

The vast majority (73 per cent) of respondents have savings, primarily to be able to afford unforeseen major expenses and to be prepared in cases of emergency. Retirement provision comes in third place. But people have to be able to afford to save; in fact, people save less the older they get. And it tends to be people with higher levels of education and higher incomes who put aside higher sums (from €200 a month).

And those who save tend take out fewer loans: 69 per cent of respondents do not use consumer loans. Men (34 per cent) tend to take out these loans more often than women (28 per cent) to fulfil their own wishes or make short-term purchases.

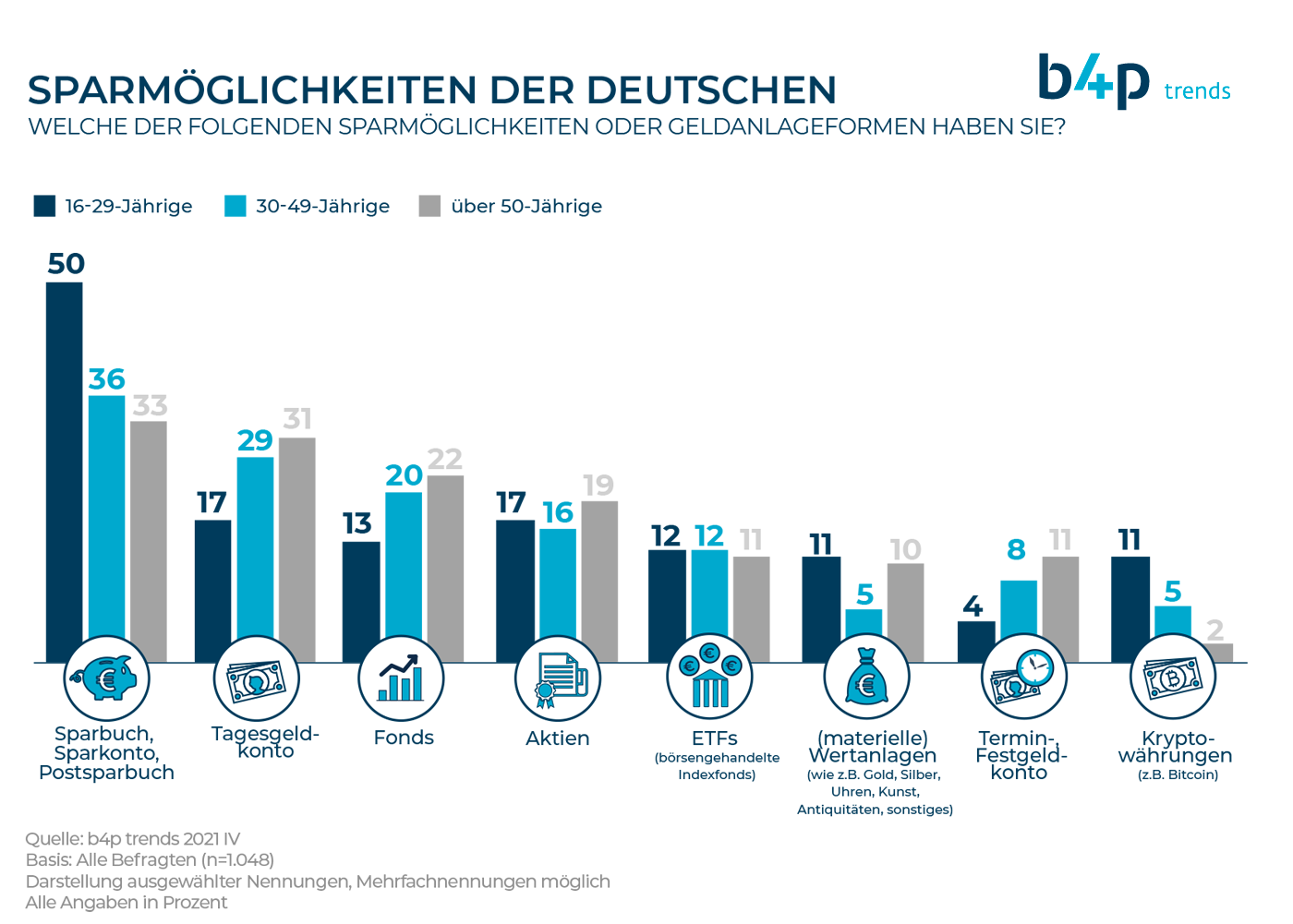

The German’s favourite investment is the savings book. More than one in three (38 per cent) use a savings book, savings account or postal savings account in order to save money. Instant access accounts, which are used by more than a quarter (27 per cent) of respondents, come in second place. Nearly one-fifth use funds (19 per cent) or stocks (18 per cent) as an investment option. One in eight (12 per cent) invests part of their money in ETFs (exchange-traded funds).

Respondents who plan to use at least one of the investment or savings options surveyed in the next 12 months prefer to make their choices digitally. Almost two-thirds (62 per cent) of respondents would consider using online/direct banking or online brokering/trading. In particular, this reflects younger people who responded, but also more than half of those aged 50 years and older. Online banking (62 per cent) is followed at a considerable distance by branch banks (41 per cent).

More about b4p trends

The best for planning trends (b4p trends) study satellite offers an opportunity to provide data on highly topical issues regarding media use, product innovations and consumer behaviour within a few weeks. At the same time, GIK checks how relevant current developments are and, in the process, estimates the potential for the main b4p study and keeps it up to date. The study results of b4p trends are collected via online survey in six to ten waves per year. Sample and population: approx. n=about 1,000 cases per wave, representative of total Internet users in Germany aged 16 years and over.

Materials

The study results of all b4p trends issues published to date, as well as graphics, can be found on the GIK website at www.gik.media/b4p-trend.